Commander in Pips: Ok, son, now we are shifting to the trading process directly.

Commander in Pips: Well, there is still a long way to that moment, son. I’m not saying that “we start to make trades”. I’ve just said that we now turn to trading process education.

As we’ve already discussed, FOREX is a market where you exchange one currency for another. In other words, you buy one currency for another one (i.e. selling the other currency). In this sense, the trading process is absolutely the same as on the other markets – stocks, bonds, real estate. When you buy something, you pay money and expect that this asset will increase in price. So as on FOREX – buying a particular currency, you expect that it will increase in value compared to other currency that you’ve sold, i.e. paid for the currency that you’ve bought. We’ve already touched on this topic lightly in Part 1 Chapter 2 and 3. Now let’s see how a common transaction looks on FOREX:

Typical transaction:

1. Assume that current GBP/USD rate is 1.5500. And you intends to Buy 10 000 GBP. The question is: how much USD you have to pay for 10 000 GBP?

2. Now, assume that after some days have passed, the GBP/USD rate has changed to 1.60. And you wish to exchange 10 000 GBP, that you’ve received during initial transaction, back into US Dollars. The question is: how many USD will you get from this reverse transaction?

Commander in Pips: That’s right – here is how the market works and where your profit is coming from. In fact you’ve calculated all the necessary transactions by yourself. It’s not so difficult, right?

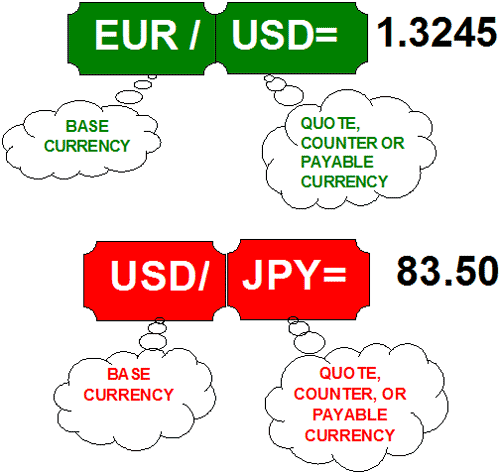

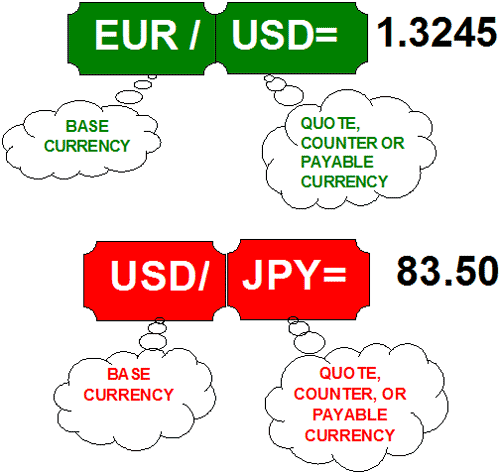

The second part of your question is much more important. And here is the rule: the primary placed currency that stands before the slash (/) calls “Base Currency”, the secondary, placed after the slash, one calls “currency payable, quote currency or counter currency”. Both currencies have different functions.

Important note:

According to ISO 4217 international three-letter code of the currencies involved. It means that each currency pair constitutes as an individual trading product and is traditionally noted XXXYYY or XXX/YYY, where XXX and YYY. The first currency (XXX) is the base currency that is quoted relative to the second currency (YYY), called the counter currency (or quote currency). Historically, the base currency was the stronger currency at the creation of the pair. However, when the EUR was created, the European Central Bank mandated that it always be the base currency in any pairing.

Now let’s tight together such notions as “lot size”, “unit of currency”, “Base currency” and “Quote currency.

1. Base currency calls in such way, because it’s the basis for any transaction. When you Buy or Sell, it means that you buy or sell the Base currency. Also, the fluctuation of the exchange rate directly shows the appreciation (rate increasing) or depreciation (rate decreasing) value of the base currency relative the quote currency.

2. Exchange rate always shows the number of units of the Quote currency per unit of Base currency and lot size in turn shows the number of units of Base currency:

- If you would like to Buy, the rate shows how much units of the quote (second placed) currency you should to pay for 1 unit of the Base currency.

- If you would like to Sell, rate, in turn, shows how much units of quote currency you’ll get for 1 Unit of the Base currency.

3. You should “Buy” the pair if you think that the base currency will appreciate compared to the quote currency. If you believe that it will depreciate, rather, then you would “Sell” it.

Now let’s discuss such terms as:

LONG and SHORT positions

When you’ve already come to decision about what you would like to do – Buy or Sell, just remember some terms that will help you understand what other traders are saying.

If you intend to “Buy” (other words buy base currency and sell quote currency), it means that you count on the rising value of base currency and would like to sell it back later at a higher price. Traders call this as “Going LONG” or “taking LONG positions”. Other words BUY=LONG.

If you intend to Sell, rather (sell base currency and buy quote currency), you count on decreasing of the value of basis currency, then you can buy it back at a lower price. This kind of action is called “Going SHORT” or “taking SHORT positions”. Other words SELL=SHORT.

And the last small topic for today –

How to read the quote board?

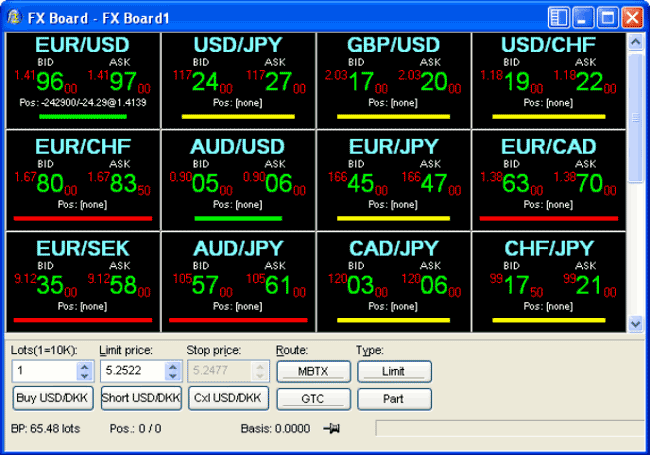

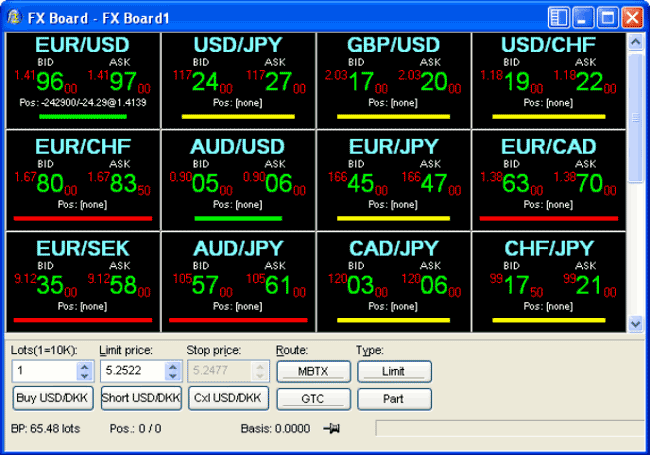

Ok, look at the picture below. This is a very typical quote board of a typical FX broker – what can you tell me about the data that it shows?

Bid – this is like on auction. The participants call the bids for some goods. The better bid will win. So, Bid price is a quote, that broker gives you for base currency. This is the price that broker wishes to buy at, other words that he agrees to pay for base currency.

Ask (or Offer price) – Broker asks you to pay this price or offer you to pay. This price is that he agrees to sell at.

Just remember, that quote board belongs to broker, hence, these quotes are the prices at which BROKER Buy or Sell, not you. What does it mean for you?

Pipruit: Finally, Sir. I really can’t hold myself back anymore and want to make my first trade now.

Commander in Pips: Well, there is still a long way to that moment, son. I’m not saying that “we start to make trades”. I’ve just said that we now turn to trading process education.

Commander in Pips: You’re absolutely right with that. Besides, all things that we are starting to discuss have absolutely practical importance.Pipruit: Oh, again this long time of expectation an explanation. But I hope that the trading process discussion is more interesting than the previous topics all together…

Commander in Pips: Very well.Pipruit: Cool, let’s getting started with it!

As we’ve already discussed, FOREX is a market where you exchange one currency for another. In other words, you buy one currency for another one (i.e. selling the other currency). In this sense, the trading process is absolutely the same as on the other markets – stocks, bonds, real estate. When you buy something, you pay money and expect that this asset will increase in price. So as on FOREX – buying a particular currency, you expect that it will increase in value compared to other currency that you’ve sold, i.e. paid for the currency that you’ve bought. We’ve already touched on this topic lightly in Part 1 Chapter 2 and 3. Now let’s see how a common transaction looks on FOREX:

Typical transaction:

1. Assume that current GBP/USD rate is 1.5500. And you intends to Buy 10 000 GBP. The question is: how much USD you have to pay for 10 000 GBP?

Commander in Pips: Absolutely right, by the way – 10 000 units of currency – is that a standard lot or not?Pipruit: Well, it’s an easy riddle: 10 000*1.5500 = 15 500 USD.

Commander in Pips: Correct.Pipruit: As I remember from previous lessons, a standard lot is 100 000 units, so 10 000 is 0.1 lot. That’s sometimes called a mini-lot, right?

2. Now, assume that after some days have passed, the GBP/USD rate has changed to 1.60. And you wish to exchange 10 000 GBP, that you’ve received during initial transaction, back into US Dollars. The question is: how many USD will you get from this reverse transaction?

Pipruit: I suppose it would come to 10 000*1.60 = $16 000...

Wait a minute! – There is a profit right here! It looks like – we’ve paid $15 500 on the initial transaction buying 10 000 GBP and got back $16 000 on the reverse transaction for the same 10 000 pounds – our profit is 500 bucks!

Commander in Pips: That’s right – here is how the market works and where your profit is coming from. In fact you’ve calculated all the necessary transactions by yourself. It’s not so difficult, right?

Commander in Pips: I suppose that you can answer on this question by yourself. Just calculate how many USD you will get from the reverse transaction in this case…Pipruit: Not at all. But, Commander, what will happen if he Cable rate will decline instead of increasing – to 1.50 for example…

Commander in Pips: In fact it’s not so awful, because we will spend a lot of time in later chapters learning about risk management and an appropriate trading plan that will allow you to control losses and escape wrong trades. But now you must understand that FOREX is not the game at all. If you’re air-headed and lack discipline – you’re dead fiscally…Pipruit: Ok, let’s see… 10 000*1.50 = $15 000. But we will lose $500 in this case! What should we do now, that’s awful!

Commander in Pips: Well, the money does not disappear. It becomes a profit of your counterparty in this trade. Money does not disappear anywhere and does not appear from nowhere. It is always on the market, and just changes hands. That’s all.Pipruit: I will try to learn hard to understand all things perfectly and do not lose money. By the way, where does this 500 bucks disappear to?

Commander in Pips: Ok then. Now we can say that any exchange rate just shows the price of one currency in terms of paying for it in another currency. It is simply the ratio of value of one currency to another.Pipruit: Ok, I remember that. Besides, we’ve discussed this lightly in Introduction to FPA Forex Military School.

Commander in Pips: Well, the placement of USD in pair was historically based. There is no hidden pattern in it. I just can tell you that in the currency futures market pairs such as JPY/USD, CHF/USD exist, compared to USD/JPY and USD/CHF that we have on FOREX.Pipruit: Why in different pairs does US dollar change from being first turn or move into second place. For example, EUR/USD compares to USD/JPY. What is the reason for this?

The second part of your question is much more important. And here is the rule: the primary placed currency that stands before the slash (/) calls “Base Currency”, the secondary, placed after the slash, one calls “currency payable, quote currency or counter currency”. Both currencies have different functions.

Important note:

According to ISO 4217 international three-letter code of the currencies involved. It means that each currency pair constitutes as an individual trading product and is traditionally noted XXXYYY or XXX/YYY, where XXX and YYY. The first currency (XXX) is the base currency that is quoted relative to the second currency (YYY), called the counter currency (or quote currency). Historically, the base currency was the stronger currency at the creation of the pair. However, when the EUR was created, the European Central Bank mandated that it always be the base currency in any pairing.

Now let’s tight together such notions as “lot size”, “unit of currency”, “Base currency” and “Quote currency.

1. Base currency calls in such way, because it’s the basis for any transaction. When you Buy or Sell, it means that you buy or sell the Base currency. Also, the fluctuation of the exchange rate directly shows the appreciation (rate increasing) or depreciation (rate decreasing) value of the base currency relative the quote currency.

2. Exchange rate always shows the number of units of the Quote currency per unit of Base currency and lot size in turn shows the number of units of Base currency:

- If you would like to Buy, the rate shows how much units of the quote (second placed) currency you should to pay for 1 unit of the Base currency.

- If you would like to Sell, rate, in turn, shows how much units of quote currency you’ll get for 1 Unit of the Base currency.

3. You should “Buy” the pair if you think that the base currency will appreciate compared to the quote currency. If you believe that it will depreciate, rather, then you would “Sell” it.

Now let’s discuss such terms as:

LONG and SHORT positions

When you’ve already come to decision about what you would like to do – Buy or Sell, just remember some terms that will help you understand what other traders are saying.

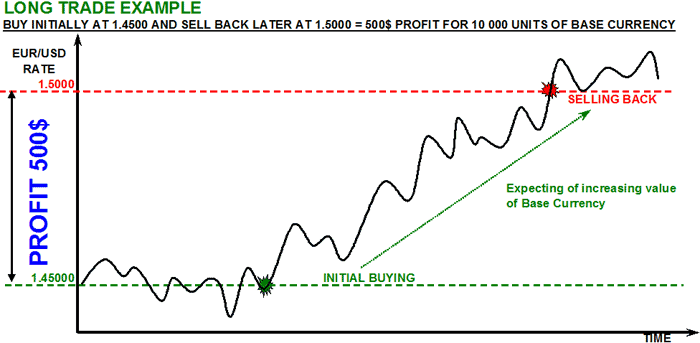

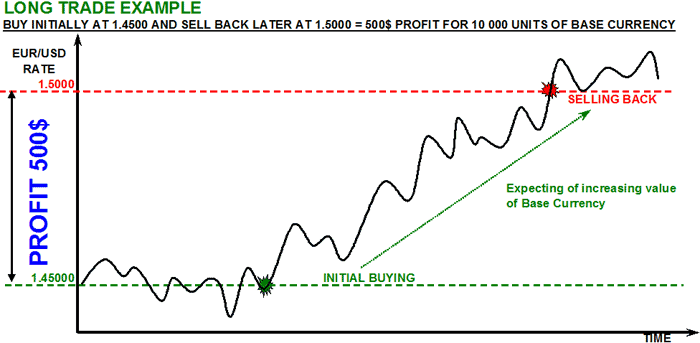

If you intend to “Buy” (other words buy base currency and sell quote currency), it means that you count on the rising value of base currency and would like to sell it back later at a higher price. Traders call this as “Going LONG” or “taking LONG positions”. Other words BUY=LONG.

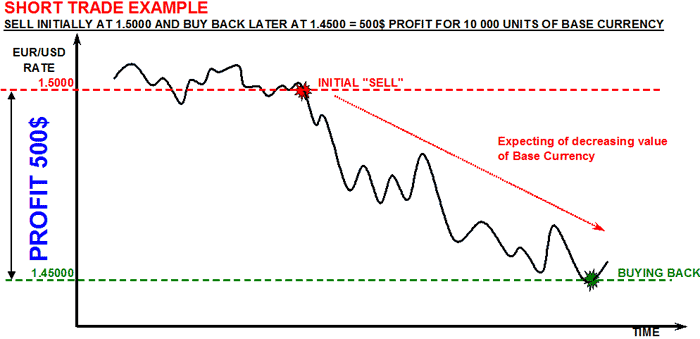

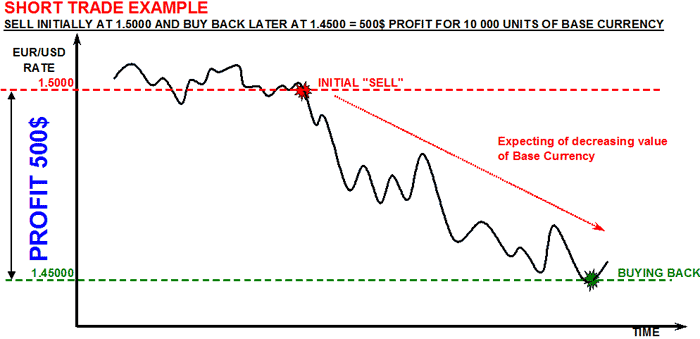

If you intend to Sell, rather (sell base currency and buy quote currency), you count on decreasing of the value of basis currency, then you can buy it back at a lower price. This kind of action is called “Going SHORT” or “taking SHORT positions”. Other words SELL=SHORT.

Commander in Pips: Ok, I’ll show you this on the chart…Pipruit: Sir, I do not quite understand where the profit on a Short position comes from. It’s clear on Long positions – buy, wait until the price has risen, then sell at higher price and profit in your pocket. With short positions it’s not so clear.

Commander in Pips: You’re absolutely right – in a “Short” trade you make money on a decreasing of the rate, in a “Long” trade – on its increasing.Pipruit: Wait a minute, it looks like I’m understanding it now. When my initial trade is “Sell”, in anticipation of a decrease in the exchange rate it is called a “Short”. I make money on the falling of the exchange rate. With “Long”, it is much simpler - it’s just a common trade Buy cheaper and Sell “at or better”.

Commander in Pips: Oh yes, don’t worry too much about it. A growing market (prices rising) is often named as a “Bull market”, a falling one as a “Bear market”. So, very often, opening “Long” positions can also be called opening “Bullish” positions. A “Short” one is named as “Bearish position”.Pipruit: Commander, also I’ve heard something about Bull and Bear markets and trades. Can you explain that?

And the last small topic for today –

How to read the quote board?

Ok, look at the picture below. This is a very typical quote board of a typical FX broker – what can you tell me about the data that it shows?

Commander in Pips: Excellent! You’ve done well! For now, don’t pay attention to the buttons that you’ve said “don’t understand them” - Limit price, Stop price, Route, Type, GTC, Part and others. We will talk about them in later chapters. And now just tell me, how do you understand the double quoting?Pipruit: Let’s see. Well, I see quotes for different pairs. Bid price and Ask price. Looks like we’ve discussed them earlier, but I forget all the details. These prices are different. I assume that the color stripe shows dynamic of the pair through the trading day – green line means appreciation of the rate, i.e. base currency, red line – depreciation, yellow means flat or near flat price action.

In table below the quote board I see different windows.

- “Lots (1 Lot=10K)” means that 1 Lot equals 10 000 units of base currency (not 100 000, as usual);

- Some windows I do not understand – Limit price, Stop price, Route, Type, GTC, Part and others.

- But I see easy way to open trade – “Buy USD/DKK” button, and look – “Short USD/DKK” button. That is what we’ve just discussed!

EXAMPLE OF A BROKER’S QUOTE BOARD

Commander in Pips: You are wrong. It’s vice versa. You have to keep in mind that these quotes belong to broker. So, Bid price is the price at which broker wants to Buy Base Currency for quote currency. The Ask price – is price at which broker wants to Sell the Base Currency. It’s very easy to remember.Pipruit: It seems simple. The first price is that I buy at, the second one - which I sell at. It’s obvious…

Bid – this is like on auction. The participants call the bids for some goods. The better bid will win. So, Bid price is a quote, that broker gives you for base currency. This is the price that broker wishes to buy at, other words that he agrees to pay for base currency.

Ask (or Offer price) – Broker asks you to pay this price or offer you to pay. This price is that he agrees to sell at.

Just remember, that quote board belongs to broker, hence, these quotes are the prices at which BROKER Buy or Sell, not you. What does it mean for you?

Commander in Pips: As you can see, the quoting system is quite simple. Just click the button and you can easily buy or sell any currency.Pipruit: Let’s see. If Bid is a price that broker agrees to pay per unit of base currency – this will be the rate that I will have to Sell at.

The same as Ask price is a price that broker Asks me to pay for 1 unit of base currency. So this will be the price that I will have to Buy at.

3 comments:

Wonderful web site. Lots of helpful information here. I'm sending it to several pals ans also sharing in delicious. And certainly, thank you on your sweat!

my web page :: need money today free

oakley, gucci, converse outlet, abercrombie and fitch, instyler, ray ban, soccer jerseys, lululemon, iphone cases, nike trainers uk, hollister, louboutin, valentino shoes, vans, reebok outlet, insanity workout, soccer shoes, nike roshe run, baseball bats, ghd hair, north face outlet, vans outlet, giuseppe zanotti outlet, p90x workout, lancel, nike air max, herve leger, mcm handbags, timberland boots, asics running shoes, wedding dresses, hollister clothing, bottega veneta, longchamp uk, nfl jerseys, babyliss, hollister, new balance shoes, chi flat iron, jimmy choo outlet, ralph lauren, north face outlet, hermes belt, beats by dre, mont blanc pens, celine handbags, nike air max, mac cosmetics, ferragamo shoes, nike huaraches

ugg uk, replica watches, moncler, moncler uk, karen millen uk, moncler, pandora jewelry, hollister, canada goose, juicy couture outlet, moncler outlet, juicy couture outlet, louis vuitton, moncler, montre pas cher, links of london, canada goose, toms shoes, supra shoes, louis vuitton, thomas sabo, canada goose uk, doudoune moncler, ugg,ugg australia,ugg italia, ugg, canada goose jackets, swarovski crystal, ugg,uggs,uggs canada, louis vuitton, pandora uk, moncler outlet, canada goose outlet, louis vuitton, marc jacobs, wedding dresses, moncler, canada goose outlet, swarovski, ugg pas cher, canada goose, pandora jewelry, coach outlet, canada goose outlet, louis vuitton, pandora charms

Post a Comment