Commander in Pips: You’ve asked the right question, son. Indeed the part of pure banking transactions jas become lower. So let’s talk about the different participants on the market and their role in FOREX.Pipruit: Greetings, commander, I’ve heard that in recent time the share of bank’s transaction on FOREX becomes lower than even 10 years ago, and you’ve said that FOREX in general an interbank market. So, who are the major participants in FOREX trading?

According to a study by the of Bank for International Settlement, in early 90’s banks were responsible for 90% of FOREX transactions. That meant that in 9 out of 10 trades, the FX desk of some bank was on one side of the transaction. By 1998 this number gradually reduced to approximately 82%. In 2004 this number was lightly below 65% and current estimate tells us that banks barely account for about half of transactions, about 53%. Now we are talking about the spot FOREX. On other market segments, such as swaps for example, the share done by bank could reach as much as 90%.

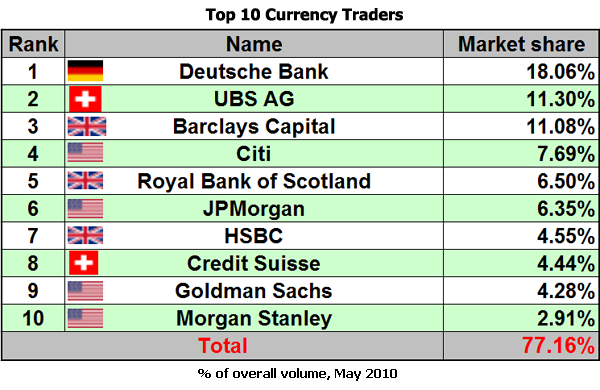

So, as we’ve discovered, the biggest participants in the FX market are banks. What banks? According to a survey by Euromoney FX, the top 10 currency traders are:

In fact, you can see that Large Banks determine the trading conditions on FOREX. Because FOREX is an Interbank market. Due to huge trading volume among themselves, these banks, that I’ve mentioned in the table have very tight spreads – 0.00005-0.0001 or even no spread at all. In fact we trade FOREX with spread that is based on their estimation. It means that if they will widen this spread for some reason, then, we also will see wider spreads on our computers. Every large bank could have billions USD of daily turnover on behalf of customers and for the bank’s own account.

Another type of large participants are Commercial companies and multi-national corporations. Their task on FX market is usually twofold. First, they make foreign exchanges to pay for goods or services or to pay employees in different countries. Second, they need to hedge their currency risks, if for example, the revenue of a company is earned in another currency, outside the region of domiciliation, i.e. so-called export companies. Excellent examples of such companies are almost the whole Japanese economy. What is a currency risk? For example, Toyota Motors sells cars in US for US Dollars, and during the year the Yen becomes more expensive compared to US Dollar (the yen’s rate becomes higher). It means that when they will convert revenues that they’ve received from US sales in USD into Yen – the revenue will be lower, because the rate of yen becomes higher and Toyota will receive less Yen for each US Dollar of revenues. At the same time, many expenditures stay the same, because Toyota pays Japanese employees in yen. It leads to lower net profits for the company in yen. That is a currency rate risk.

But it’s worth saying here, that companies trade much smaller amounts of currency compare to banks and speculators. At the same time trade flows could have a significant short term impact on currency rates, such as when large multi-national corporations close or open positions that are unexpected by other market participants.

Central banks, such as the ECB, Bank of Japan or Fed Reserve, can also actively take part in the FOREX market for their own purposes. It could be, for example, international government payments, foreign reserves transactions or other processes. The major event that strongly influences the FX market is changing the interest rate by some national bank. They do this to try to control inflation and to stimulate economic growth. By doing this, central banks can affect the national currency valuation. Due to having official or non-official target rates for their currencies, Central banks can intervene as directly as verbally, if their assessment of national currency rate to other ones seems too high or too low. Usually such kind of interventions or its announcement can lead to a strong move in the market, but only in a very short term period. As we’ve said earlier even Central Banks can’t struggle with combined resources of other participants in the long term.

Hedge funds control billions of dollars and could borrow even more. As we already know, 70-90% of transactions on FX market have a speculative nature. So since 1996, hedge funds are the greatest part of these transactions after banks. They even can struggle with Central Banks intervention at predetermined circumstances.

Investment management firms, such as pension funds, mutual funds and endowments, who usually manage large accounts on behalf of their clients, use the FX market to facilitate transactions in foreign securities. For example, if some mutual fund that is domiciled in US intends to purchase stocks of some Japanese company, it needs to convert a sufficient amount of USD into JPY to accomplish this purchase. During recent times, such investment management firms started to hire FX specialists that control their currency exposure depending on expectations of future currencies rates change. For example, some fund has 10% in cash and anticipates EUR/USD rate growth in nearest time, so they could exchange USD cash into EUR to get some appreciation of their value assets in USD.

Retail foreign exchange brokers are the companies, who mostly deal with individuals, private investors or small commercial companies. They are, in fact, rivals to banks who provide the same services. Sometimes FX retail brokers are confused with market makers, but they are not the same. An FX broker acts on the FX market as an agent of a customer by seeking the best price in the market for a retail order and dealing on behalf of this customer. They charge a fee/commission in addition to the price obtained in the market.

Market makers are quite different companies, although there is not much different with FX brokers at first look. They typically act as principal in the transaction versus the retail customer, and quote a price they are willing to deal at—the customer has the choice whether or not to trade at that price. They do not usually charge any additional fee except for the bid/ask spread that we’ve discussed already in previous chapter. Although this spread may be as small as 0.0002-0.0005, a market maker still can get a significant profit due to large amount of transactions with their customers. In fact, roughly speaking, market makers break their own one big trade with large bank on the one side, into many small trades with small customers (individuals) from another side. And without this type of transaction, it would be very difficult to for most individuals to trade FOREX.

In assessing the suitability of an FX trading service, the customer should clearly understand the difference of whether the service provider is acting as principal (Market maker) or agent (Broker). When the service provider acts as agent, the customer is generally assured of a known cost above the best inter-dealer FX rate. When the service provider acts as principal, no commission is paid, but the price offered may not be the best available in the market—since the service provider is taking the other side of the transaction, a conflict of interest may occur.

Currently, FX Market Makers usually have wider spreads, especially in the retail segment of FX business that primarily deals with individuals.

Non-bank foreign exchange companies take a small part of overall FOREX market. In fact, they offer currency exchange and payments to individuals or small companies. They are almost akin to FX brokers but do not offer speculative trading – only money transfer/payments in conjunction with currency exchange procedure. In fact they are involved in real delivery transactions, although with small volumes.

Money transfer/remittance companies are almost the same to Non-bank foreign exchange companies, but they offer primarily money transfer, and may charge more for currency exchange, if they offer it at all. One of the best known money transfer companies is Western Union. The annual value of remittances is about $370-400 billion.

ECN (Electronic Communications Network) – we’ve talked about this type of participant already, so I’ll just give the short reminder here. This is a type of electronic system that facilitates trading of financial products. In fact, ECN is some kind of electronic server that matches contra-side orders of participants/subscribers (i.e. a sell-order is "contra-side" to a buy-order with the same price and share count) for execution. The ECN will post unmatched orders on the system for other subscribers to view. Generally, the buyer and seller are anonymous, with the trade execution reports listing the ECN as the party. In fact, this is small private exchange that has a bit different and separate regulation rules by law.

To trade with an ECN, one must be a subscriber or have an account with a broker that provides direct access to trading with particular ECN. The most well-known ECN is NASDAQ. An example of a FOREX ECN platform is Currenex.

1 comment:

oakley, gucci, converse outlet, abercrombie and fitch, instyler, ray ban, soccer jerseys, lululemon, iphone cases, nike trainers uk, hollister, louboutin, valentino shoes, vans, reebok outlet, insanity workout, soccer shoes, nike roshe run, baseball bats, ghd hair, north face outlet, vans outlet, giuseppe zanotti outlet, p90x workout, lancel, nike air max, herve leger, mcm handbags, timberland boots, asics running shoes, wedding dresses, hollister clothing, bottega veneta, longchamp uk, nfl jerseys, babyliss, hollister, new balance shoes, chi flat iron, jimmy choo outlet, ralph lauren, north face outlet, hermes belt, beats by dre, mont blanc pens, celine handbags, nike air max, mac cosmetics, ferragamo shoes, nike huaraches

Post a Comment