Commander in Pips: Ok, troops, let’s get started with this. I suppose most of you, at least once, went to another country. As you know, different countries usually have different currencies. If you are in London, for example, you need British pounds to take a date out for dinner in restaurant. If you’re in Osaka – you need Japanese yen instead. And what do you usually do, when you’ve just arrived at the London airport? Yes, you’re searching for a currency exchange center to change some of your US Dollars or whatever else you have for British Pounds. Congratulations, when you’re doing this, you’ve just become a FOREX market participant.

When your trip is coming to an end, and you start to think about returning home, you look in your wallet and find some British pounds there and think to yourself...

- Say, I don’t need them any more; it needs to exchange them back to bucks in airport…

You arrive at the airport for departure and visit the same exchange center. And what do you see? The exchange rate has changed! When you’ve just arrived, you converted $170 and got 100 Pounds. But after two weeks have passed you convert 100 pounds and received $171! You just made your first dollar trading FOREX.

But just one note is worth saying here – not all currencies are freely convertible. Some currencies do not have an absolutely natural rate of exchange. Usually, it happens when government puts a ceiling and floor for national currency fluctuations. One of the best examples is Chinese Yuan, which trades in a narrow range each day. The most obvious purpose of this is economic protection of national manufacturing. A few countries even artificially lock their exchange rates so they don’t fluctuate at all. Usually, you can only buy those currencies when you arrive in the country and have to change whatever is left back to your original currency when you leave

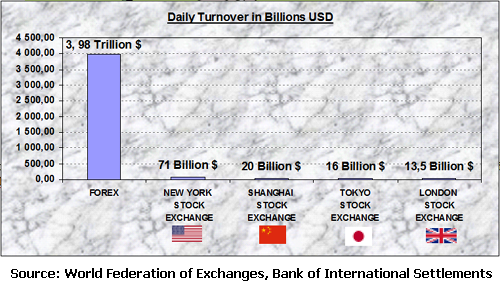

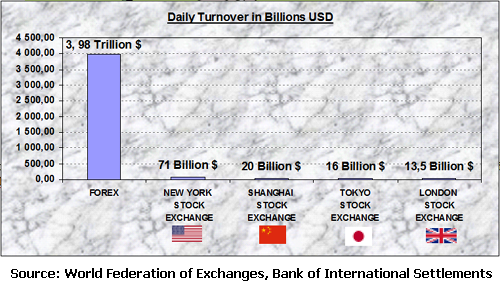

Commander in Pips: Oh yeah? And now look at this little chart I found for you - just compare the dollar value of daily turnover, son…FOREX is not just big compared to the stock market, it’s huge.

Commander in Pips: But don’t get too carried away. We trade Spot FOREX, not forwards, swaps and a lot of other stuff that you don’t understand yet. So, the share of retail trading, that spot trading also belongs to, is below the half of overall FX volume – approx. $1.5 trillion. But this is still more than enough, believe me…

Commander in Pips: Hold on, son. Don’t be hasty. Remember what we’ve talked about in the introduction – discipline. If you don’t have discipline, you’ll probably lose all your money in the wink of an eye. But I can still give you a fast answer – almost as fast as you are:Pipruit: Ok, ok – let’s shift to trading - how to make money on the FOREX market? I do not need all this theory, let’s trade…

When your trip is coming to an end, and you start to think about returning home, you look in your wallet and find some British pounds there and think to yourself...

- Say, I don’t need them any more; it needs to exchange them back to bucks in airport…

You arrive at the airport for departure and visit the same exchange center. And what do you see? The exchange rate has changed! When you’ve just arrived, you converted $170 and got 100 Pounds. But after two weeks have passed you convert 100 pounds and received $171! You just made your first dollar trading FOREX.

Commander in Pips: Right, the situation is similar in other countries – Australia, the EU, New Zealand, Russia, China etc. There is no big deal about choosing the particular country for example. The point is that different countries have different currencies and there is a world wide mechanism that makes it easy to make an exchange from one currency to another - and in huge volumes. That is FOREX.Pipruit: Cool! This is it that allows me to make money on FOREX – fluctuations of the exchange rate!

But just one note is worth saying here – not all currencies are freely convertible. Some currencies do not have an absolutely natural rate of exchange. Usually, it happens when government puts a ceiling and floor for national currency fluctuations. One of the best examples is Chinese Yuan, which trades in a narrow range each day. The most obvious purpose of this is economic protection of national manufacturing. A few countries even artificially lock their exchange rates so they don’t fluctuate at all. Usually, you can only buy those currencies when you arrive in the country and have to change whatever is left back to your original currency when you leave

Commander in Pips: Not quite. These people are just the smallest tip of the iceberg. Where do you think the foreign currency from exchange centers is transferred to?Pipruit: So, FOREX is just a number of people who change their currencies in exchange centers, isn’t it?

Commander in Pips: Right, you just pointed out the biggest participants in the FX market – banks. There are many different banks – large and small, but the largest are transnational banks and government central banks. These large banks are major participants of FOREX market. All these participants link with each other.Pipruit: Well, different exchange centers belong to different banks, so it seems that currency is also…

Commander in Pips: You could do it in this way, but do you really want to sit in the bank lobby or at the airport watching the quote board? There is a much better way to trade. There are special institutions that exist just for this purpose – Retail FOREX brokers. Their business is to provide fast and simple access to the FOREX market to all who wish to trade, even to individuals. All that you have to do is to sign a typical agreement and transfer money to your trading account.Pipruit: Wait a minute. But how we should trade currency, via exchange centers in banks?

Commander in Pips: Well, I’ll show you… FOREX daily turnover was reported to be over 3.98 trillion US dollars in April 2010.Pipruit: Sounds good. Look’s like it’s really simple. And how big is the FOREX market? I’ve heard from friend of mine, she’s a broker, that there are some markets that are illiquid. As she told me, “illiquid” means insufficient demand or supply volumes, i.e. low trade volume, so you can’t always find a willing buyer or seller. Does FOREX have the same problems?

Commander in Pips: Do you know about equity markets and particularly about the New York Stock Exchange? What do you think, is the stock market large and liquid enough?Pipruit: What does it mean? Is that a lot or only a little compared to other markets?

Pipruit: I think so. When I watch business media, such as CNBC and Bloomberg, they talk about the stock market all the time – the S&P 500 is moving higher or the Dow Jones Index moving lower. They never say anything about people not being able to buy or sell. So that is a liquid market, I suppose.

Commander in Pips: Oh yeah? And now look at this little chart I found for you - just compare the dollar value of daily turnover, son…FOREX is not just big compared to the stock market, it’s huge.

Pipruit: Incredible!

Commander in Pips: But don’t get too carried away. We trade Spot FOREX, not forwards, swaps and a lot of other stuff that you don’t understand yet. So, the share of retail trading, that spot trading also belongs to, is below the half of overall FX volume – approx. $1.5 trillion. But this is still more than enough, believe me…

1 comment:

ugg uk, replica watches, moncler, moncler uk, karen millen uk, moncler, pandora jewelry, hollister, canada goose, juicy couture outlet, moncler outlet, juicy couture outlet, louis vuitton, moncler, montre pas cher, links of london, canada goose, toms shoes, supra shoes, louis vuitton, thomas sabo, canada goose uk, doudoune moncler, ugg,ugg australia,ugg italia, ugg, canada goose jackets, swarovski crystal, ugg,uggs,uggs canada, louis vuitton, pandora uk, moncler outlet, canada goose outlet, louis vuitton, marc jacobs, wedding dresses, moncler, canada goose outlet, swarovski, ugg pas cher, canada goose, pandora jewelry, coach outlet, canada goose outlet, louis vuitton, pandora charms

Post a Comment